Algorithmic trading comes up in news stories almost every week. What many don’t realize is that it is actually a very broad term. Here is how Investopedia defines it.

“Algorithmic trading (automated trading, black-box trading or simply algo-trading) is the process of using computers programmed to follow a defined set of instructions (an algorithm) for placing a trade in order to generate profits at a speed and frequency that is impossible for a human trader. The defined sets of rules are based on timing, price, quantity or any mathematical model. “

Michael Lewis also wrote an excellent book on the subject entitled Flash Boys: A Wall Street Revolt.

My first introduction to trading and investing came while working for Delphi Economics from 1988 to 1993 . Their software package, Viking, was one of the first to allow people to test and optimize strategies on their home PC. At the time the program offered a powerful, yet still somewhat limited ability for testing. One of my first tasks was helping write the English language manual and user guide complete with sample code to help customers get started testing their own ideas. In a very short period of time I became a power-user.

Designing and testing trading models is something I have remained interested in ever since. For me, they remain as some of the most interesting computational puzzles to work on. I have always enjoyed optimizing methods to solve puzzles. One of my favorite projects as an undergrad at Columbia was The 8 Puzzle Composer: Hearing the Solution. Writing the code to solve the puzzle involved trying various heuristics to trim the solution space in order to speed up and generalize for a higher and higher term N x M sliding puzzle.

During the 1990s and early 2000s I spent a great deal of time working with audio data, which is in fact quite similar to stock market data. They are both time-based and many of the same analysis tools can be used on both (eg., the Fourier and other transforms). As the speed of computing technology continued to advance, I developed new skills that gave me fresh insights on how one might go about building a system to test, optimize and implement a wide variety of trading strategies.

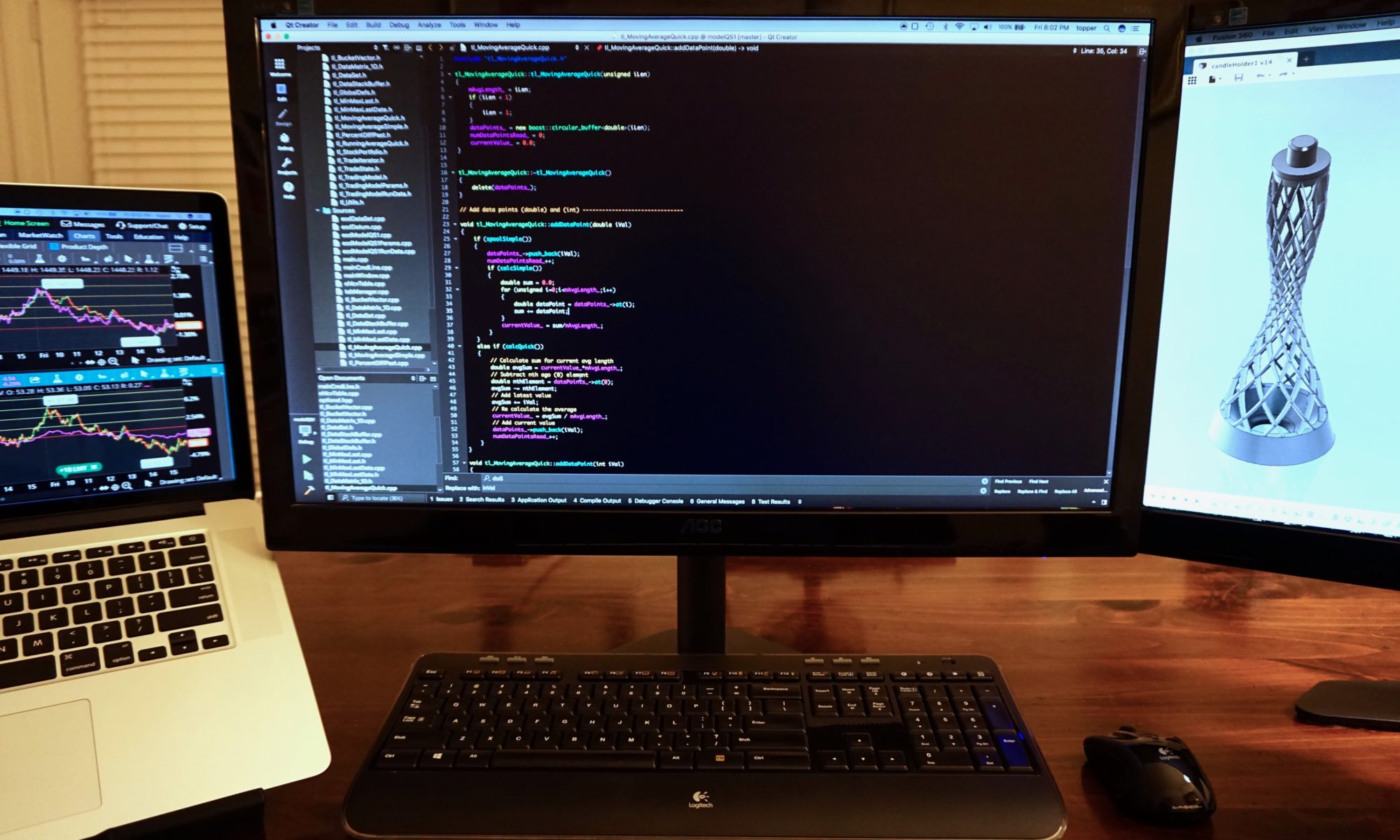

In 2010 I decided to revisit the notion of investing using algorithms. To my surprise I found most commercially available tools lacking in various abilities I needed. So I decided to start building my own. I have continued to evolve my system ever since. In 2016 I became a full-time day-trader using the tools I continue to develop.